Commercial Auto Insurance Rates Spiking

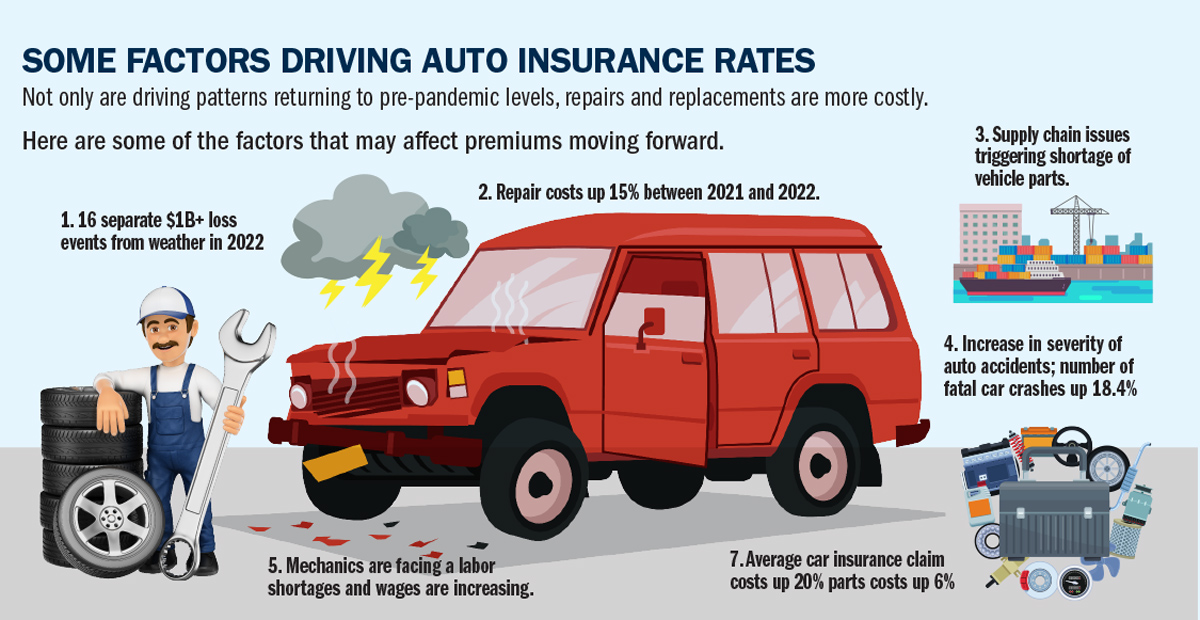

Skyrocketing claims costs and higher accident rates are pressuring the commercial auto insurance market, as insurers impose increasingly larger rate hikes and more are pulling out of the market or restricting who they will cover. While rate increases have been the standard for nearly a decade, since 2022 hikes are growing larger — often in […]

July 26, 2023